Tuesday, July 31, 2012

Felty Farms Gilbert 85298 Real Estate and Homes for Sale

11:24 AM

Swee Ng

Felty Farms Gilbert 85298 Real Estate and Homes for Sale

Welcome to Felty Farms, Gilbert

Felty Farms is a cozy, family-oriented community consisting of 184 lots build by Meritage Homes and are located on the northeast corner of Lindsay and Ocotillo Roads in Gilbert.

Felty Farms is served by the Chandler Unified School District. Children in our community Kindergarten through sixth grade attend Weinberg Elementary while those in seventh and eighth attend Payne Junior High. high school students attend Perry High School.

School near Felty Farms:

View Homes for Sale in Gilbert 85298

View Homes for Sale in Gilbert

View Gilbert Bank Owned Listing

Request Bank Owned Listing email to you

Sunday, July 29, 2012

How To Lower Your Home Insurance Rate

4:35 PM

Swee Ng

Home insurance checkup could lower costs, improve coverage

The national average premium for homeowners insurance will increase by 5% in 2012, according to forecasts by the Insurance Information Institute. That follows an increase of nearly 4% in 2011, and it will bring the average annual premium to an all-time high of $1,000.

At the same time, home insurers are adding exclusions and requiring higher premiums to cover certain risks, such as mold and water damage.

Meanwhile, the housing bust and recession have pushed the median home price down 35% since the market’s peak. But the cost to rebuild a home after a total loss has increased by 40% since 2004 — 7% in 2011 alone — thanks to rising building-material and fuel prices.

So you could find yourself paying more for less coverage. Worse, you may not have enough insurance to cover the full cost of rebuilding your home and replacing its contents in the event of a fire, a tornado or some other major disaster.

Use your annual renewal notice or any improvements to your home as cues to touch base with your agent or insurer. Recheck how much insurance you really need and comparison-shop, taking advantage of opportunities to save. You can use the same tactics if you’re buying a new policy.

Check your limits

“In the aftermath of a total loss, every homeowner says, ‘My insurer told me I was fully insured,’ ” says Amy Bach, executive director of United Policyholders, a consumer advocacy group. “I’ve heard it a thousand times from people who have found themselves short—sometimes by hundreds of thousands of dollars.” She urges homeowners not to blindly trust that their home insurer has all the bases covered.

The first step in getting adequate coverage is to establish your policy’s dwelling limit. Your target number is the full-replacement cost of your home and its possessions. The dwelling limit bears no relation to your property’s market value (if you were to sell it), its appraised value (for mortgage financing) or its assessed tax value. And don’t mistake the cost of new construction for the cost to rebuild, which is more expensive because of factors such as debris removal and higher demand for materials and labor after a catastrophe. Bach says it generally costs $200 to $250 per square foot to rebuild the average home today. But if you live in a unique or historic home, in a high-end community, or in a hard-to-reach location, the cost could run $400 per square foot.

You can get a pretty good idea of what it would cost to rebuild your home by using an online calculator, available at sites such as HMFacts.com ($7) and AccuCoverage.com ($8). Both will ask you about the structural components, features and amenities of your home and, using databases of local labor and material costs, estimate your total cost to rebuild.

Your insurer or agent will probably help you determine the dwelling limit, using much the same script as the online tools do. Although you can answer many questions about your home over the phone, nothing substitutes for an on-site visit. Site visits are a routine practice for many independent agents, who represent more than one insurer, and for representatives of high-end insurers, such as Chubb and Fireman’s Fund.

The dwelling limit also determines your policy’s other coverages—typically 10% of the dwelling limit for other structures on your property, 50% for contents and 20% for loss of use of your home (additional living expenses when you can’t live in your home).

Take stock of your stuff

The amount of coverage built into your policy for the possessions in your home (as a percentage of the dwelling limit) may be inadequate to replace them. And although your policy may cover expensive items, such as jewelry and furs, it may limit the payout to $1,000 to $2,000. (Other items that may be capped include silverware, computer equipment, art, antiques, stamps, coins and guns.)

Create a home inventory to ensure that you have the right amount and type of coverage. In addition, an inventory will make filing a claim smoother, establish verifiable value for your things after a disaster, and make it easier to prove your losses for tax purposes. The Insurance Information Institute’s home-inventory iPhone app and the app from the National Association of Insurance Commissioners make saving that information a snap. Be sure to include serial numbers, photos or a video, and receipts or appraisals.

Once you know what you have and how much it will cost to replace, you can add coverage with a scheduled personal property endorsement (or personal article floater), which typically costs about $20 per $1,000 of property value annually (although it varies by item and location).

Update your inventory periodically to cover new purchases and gifts, and get updated appraisals of your valuables so that you can adjust your coverage. For example, gold jewelry inherited from Mom could be worth almost three times what it was worth five years ago.

Cover the gaps

It’s a good idea to purchase guaranteed replacement coverage, meaning the insurer will pay whatever it costs to rebuild your home with materials of like kind and quality, without deducting for wear and tear. Avoid actual cash value coverage, which pays the depreciated value of your home’s components and could leave you short of the funds necessary to fully repair or rebuild your home.

Most insurers build a fudge factor of 25% to 50% into the dwelling limit. Lacking that, you need to buy extended replacement coverage, a bargain at about $25 to $30 annually for an extra $200,000 of coverage, says Bach.

You might be tempted to save money by reducing your dwelling limit and picking up the balance with extended coverage. Two caveats here: First, you’ll reduce coverage of your contents as a percentage of the dwelling limit. Second, in the event of a total loss, your policy’s current dwelling limit must equal at least 80% of the cost to rebuild or you won’t get the benefit of any extended coverage to make up the difference.

Also, look for protection against a higher cost to rebuild due to inflation (inflation-guard endorsement) or upgraded building codes (ordinance or law endorsement).

A number of insurers have switched from the broader and more desirable all-risks coverage (covering everything except those things expressly excluded) to the more narrowly defined named-perils policy, which should cost less but may not. Request an all-risks policy, and if an insurer doesn’t offer it, look elsewhere. Review your policy’s exclusions for risks such as wind, water, earthquakes, sinkholes and flooding, and buy supplemental coverage. Flood insurance is never included in standard homeowners policies. You’ll need to get coverage from the National Flood Insurance Program (get quotes and information about flood risks for your property at www.floodsmart.gov).

Sewage backup is often excluded from homeowners insurance policies unless you get a special rider, which can often add $10,000 to $20,000 in coverage for about $50 per year. In fact, that’s one of the most common insurance gaps people discover during storm season and one of the easiest to fill. Last August, as Hurricane Irene moved up the East Coast, Steve Weisbart, chief economist for the Insurance Information Institute, was glad that he, unlike many of his neighbors, had coverage in case his sewers and drains backed up. As local sump pumps emptied water from basements into the overwhelmed sewer system, the sewage backed up into homes through toilets and drains. Weisbart collected on a $10,000 claim.

Your homeowners insurance also covers personal liability and medical payments to others. The typical policy provides $300,000 of liability coverage, which will protect you if someone is injured on your property. You can increase your coverage to $500,000 for about $25 more a year. Consider increasing your liability coverage to $1 million with an umbrella policy.

Get the best deal

When they decide whether to cover you, insurers consider factors such as the age, materials, condition and replacement cost of your home, the risk associated with your location, your claims history (the type and number of claims that you’ve filed or that your home has experienced), and your credit score.

Comparison shopping is easier if you work with an independent agent who represents many insurers (to find one, visit Independent Insurance Agents and Brokers of America). You’ll pay a commission (typically 10% to 15% of the annual premium), but it may be worth it for the guidance, and the agent should explain why one insurer or policy will better meet your needs than another. You can also get quotes from a direct-market company, such as Geico or USAA. And it’s worth checking out State Farm and Allstate, which sell through their own agents.

For specific advice about homeowners insurance in your state, visit the Web site of your state’s department of insurance, which may provide worksheets for comparison shopping. Before you buy a policy, check prospective insurers’ ratings for financial strength (at www.ambest.com) and complaint records. Also, keep a record of your communications, as well as the insurer’s assurances of coverage should there be any question of your coverage after a disaster.

via yahoo realestate

Sonoma Ranch Gilbert Real Estate and Homes for Sale

4:29 PM

Swee Ng

Sonoma Ranch Gilbert Real Estate and Homes for Sale

Welcome to Sonoma Ranch, Gilbert AZ

Sonoma Ranch is located on North East of North Val Vista Drive and East Elliot Road, homes were built in the mid 1990's by Shea Homes. Sonoma Ranch feautures walking paths, greenbelts and tots play area. Embedded in the community is Sonoma Ranch Elementary School, which is part of the Gilbert Unified School District.

School near Sonoma Ranch:

Click here to View Homes For Sale in Sonoma Ranch

Click here to View Homes For Sale in 85234

Click here to View Homes For Sale in Gilbert

Click here to View Gilbert Foreclosure Listing

Click here to Request Foreclosure Listing email to you

Wednesday, July 25, 2012

Wind Drift Gilbert AZ 85234 Homes for Sale and Real Estate

11:56 AM

Swee Ng

Wind Drift Gilbert AZ 85234 Homes for Sale and Real Estate

Last updated on September 19, 2014Located in North-West of North Val Vista Road and East Elliot Road in Gilbert AZ 85234, Wind Drift is more than just a great master-planned community. There are more than 600 homes offering beautiful homes on waterfront or off-lake home sites. Many people are attracted to the opportunity to fish, sail and boat on the lake. Homes in Wind Drift are built in early 1990 and ranging from 1,200 - about 2,500 sq/ft.

Wind Drift, Gilbert AZ 85234

Community and Demographic Information for Wind Drift

Gain valuable insight into the Wind Drift community by looking at household incomes, crime risk, education levels attained, and potential for extreme weather. Use the map to locate points of interest like shopping, restaurants, and health care services.

School in Wind Drift

Wind Drift is served by Gilbert Unified School District. School aged children attend Sonoma Ranch Elementary School, Greenfield Jr High and Gilbert High School, which is located across from the community. Access Gilbert 85234 school detailed information on school ratings, test scores by grade, student-teacher ratio, and much more.

Affordable Financing Options

Several low down payment financing options including; FHA 3.5% Down Financing, VA ZERO Down Financing, Conventional Financing and others are available. Contact Us to find out what loan programs you qualify for. Learn more about how to buy a house in Gilbert AZ with a low down payment.

Free Gilbert 85234 Market Report

Sign Up for Free Gilbert AZ 85234 Market Report. The data used this Gilbert 85234 Market Report is consolidated from multiple sources and includes current listings, recent sales, and more. Whether you’re a buyer or seller, the knowledge you gain will help put you in control of your real estate transactions.

Selling Your Home in Wind Drift?

Contact Us or call Swee Ng, Gilbert Real Estate Agent at 480.721.6253 today to discuss your potential Wind Drift House Value and our comprehensive marketing plan. We will prepare complimentary competitive market analysis (CMA) to find out what your Home is worth at today’s market.

What's My Wind Drift House Worth?

Click here to see you house value instantly and comparable

Swee Ng

Swee Ng

Keller Williams Realty

sweeng@kw.com

15905 S 46th St #160

Phoenix

,

AZ

,

85048

480-721-6253

Swee Ng, Realtor with Keller Williams Realty who live, work and play in Gilbert AZ, specialty in Residential Resale, First Time Home Buyer and Investment Homes.

Visit www.SweeEastValleyHomes.com for your Gilbert Real Estate needs.

Go to www.GilbertAZHouseValue.com to find out what your Gilbert house is worth instantly.

Tuesday, July 24, 2012

4 Emotional Mistakes Made by Home Sellers

10:29 AM

Swee Ng

Keep emotion out of selling a home

The greatest hindrance to the sale of a home can be a seller who is seized by emotion.

"It is very important for sellers to (keep) in mind that a real estate transaction is most likely the single largest financial transaction they will ever undertake," says Fiona Dogan, a realtor in the Rye, N.Y., office of Julia B. Fee Sotheby's International Realty. "It should be viewed and handled primarily as a business transaction, with cold, hard decisions being made on a financial and investment basis."

Home sellers who allow emotions and sentimental attachments to overtake them during the sales process run the risk of making hasty, sometimes poor decisions, Dogan says.

Here are some tips to help any home seller avoid making emotional mistakes that could cost money.

Home-selling emotional error: Overpricing

Getting top dollar is the dream of every home seller. But getting a buyer to pay a premium for features that are valuable only to you? That's closer to fantasy, according to Tracie Hamersley, senior vice president and associate broker at Citi Habitats in New York City.

"Overpricing often occurs because of emotional reasons," Hamersley says. "So many sellers make the mistake of thinking that their home is special and that a special buyer will pay more because they also fell in love with the property."

The truth is prices have nothing to do with the seller's emotional affinity for the property, and according to Hamersley, it's important sellers understand that as early as possible.

Sellers who bought at the top of the market likely won't see that same price from today's buyers.

"It's a different market," Hamersley explains. "If a seller bought their home during the market's peak, they may have to face the unappealing prospect of losing money on the sale in today's market. This is a difficult position for a seller to be in, but it's one that reflects today's reality."

Home-seller error: Going to a showing

There are a lot of legitimate reasons why a seller might want to be present for the home's showing. But having a seller there tends to sour the experience for most buyers, according to Renee Weinberg of Petrey Real Estate in Long Beach, N.Y.

"Getting the seller out of the house is key," Weinberg says. "Whenever we take a listing, this is explained in advance."

According to Karyn Anjali Glubis, a real estate broker and owner of The Real Estate Expert in Tampa, Fla., sellers are sensitive when buyers nitpick flaws. "Sellers think that every little thing is a complaint against how they may have maintained a property," Glubis says. The reality is that observations from buyers -- though sometimes harsh -- have nothing to do with the person selling the home.

Having a seller present for an open house or the first (or even second) showing tends to stifle potential buyers from expressing opinions. After hearing negative feedback, some sellers reject offers for emotional reasons, Weinberg says. Sellers should use their agents to insulate them from the process, filter relevant information and only meet the buyers when there's a serious offer on the table.

Home-seller errors: Rejecting early offers

Sellers be warned: The longer a property sits on the market, the worse the offers are likely to get, says Nick Jabbour, a New York City real estate agent and vice president of Nest Seekers International.

"Once a property is marketed, it will receive the most attention during the first two weeks," Jabbour says. "(The home is) new to the market, and any buyers that have been in the market for a home will see it come up. If it is priced right, an educated buyer, (who has) been in the market for a while (and) sees the home as a fit, will put a serious foot forward."

Sometimes early bids run the risk of spooking sellers who worry they underpriced their properties. But Jabbour says you can tell the property was priced correctly when an early offer is near the asking price, as long as the asking price is in line with the market.

"Waiting for a better offer is counterproductive and can result in a property languishing," Jabbour says.

Home sellers, don't take offers personally

When you're selling your home, it's easy to take everything personally. But doing so is a big mistake, according to Fiona Dogan, a realtor in the Rye, N.Y., office of Julia B. Fee Sotheby's International Realty.

"Sellers need to become emotionally detached very quickly from their homes," Dogan says. "By its very nature, a real estate transaction is aggressive and confrontational since the seller wants the highest price and the buyer wants the lowest."

That negotiation almost always means a buyer will point out every flaw with the property. But while hearing that information may sting a little, it's really a good sign, according to Dogan, because it means the buyer is serious.

"A seller needs to be ready to hear criticism of their lovely home and be able to deal with it as a negotiating tool and not take it as a personal affront and walk away from a potential sale for emotional reasons," Dogan says.

via bankrate

today for FREE Seller Consultation.

Monday, July 23, 2012

3 Bedrooms Home for Sale in Finley Farms Gilbert

3:31 PM

Swee Ng

|

|

||||

|

|

3 Bedrooms HUD Home for Sale in Finley Farms Gilbert 85296. Enjoy vaulted ceilings, separate living room and family room, spacious kitchen, neutral tile and carpet throughout! Enjoy cooking in your large kitchen, complete with island, built in microwave, gas range/oven, and pantry! Living room is ideal for formal entertaining, and bring it out back to your covered patio for all sorts of occasions.. BBQ, birthday parties, etc!

School District: 041 - Gilbert Unified District

Elementary School: Finley Farms Elementary

Jr. High School: Greenfield Junior High

High School: Gilbert High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Finley Farms Community

View Homes for Sale in Gilbert 85296

View Homes for Sale in Gilbert

School District: 041 - Gilbert Unified District

Elementary School: Finley Farms Elementary

Jr. High School: Greenfield Junior High

High School: Gilbert High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Finley Farms Community

View Homes for Sale in Gilbert 85296

View Homes for Sale in Gilbert

* Important Disclosure: The property is available at the time of this ad creation. It is very possible that an offer has been submitted or even accepted since that time. If you are interested in this property, Please call 480-721-6253 to check on its current availability.

Sunday, July 22, 2012

Ashland Ranch Gilbert Real Estate and Homes for Sale

5:09 PM

Swee Ng

Ashland Ranch Gilbert Real Estate and Homes for Sale

Last updated on August 20, 2016Ashland Ranch is located at North-West of Val Vista Dr and Williams Field Rd in Gilbert AZ 85295.The charm of this community is accented with tree-lined streets, private parks, walking trails, beautifully landscaped common areas and neighborhood tot lots. Homes in Ashland Ranch are built in late 1990 and ranging from around 1,400 - 5,000 sq/ft.

Ashland Ranch, Gilbert AZ 85295

Conveniently Located in Ashland Ranch

Ashland Ranch is only minutes from San Tan Village Mall and convenient to the 202 loop. Residents in Ashland Ranch enjoy near by shopping (Kohls, CVS, Einstein Bro Bagels, Swirl It), grocery stores (Sprouts Farmer Market), restaurant and other amenities.

School near Ashland Ranch Gilbert AZ 85295

Ashland Ranch is served by Gilbert Public School District. School aged children is attending Ashland Ranch Elementary, South Valley Jr High and Campo Verde High School.

Affordable Financing Options

Several low down payment financing options including; FHA 3.5% Down Financing, VA ZERO Down Financing, Conventional Financing and others are available. Contact Us to find out what loan programs you qualify for.

Gilbert AZ Housing Market Report

View Gilbert AZ Housing Market Report. The data used this Gilbert AZ Market Report is consolidated from multiple sources and includes current listings, recent sales, and more. Whether you’re a buyer or seller, the knowledge you gain will help put you in control of your real estate transactions.

Ashland Ranch Gilbert AZ 85295 Homes for Sale

Selling your home in Gilbert AZ

Contact Us or call Swee Ng at 480.721.6253 today to discuss your potential Gilbert AZ House Value and our comprehensive marketing plan. We will prepare complimentary competitive market analysis (CMA) to find out what your home is worth at today’s market.

What's My Gilbert AZ Home Worth?

Enter your home address and see your house value instantly for free

Ready to Sell?

- Call 480.721.6253 or Contact Us to schedule a Complimentary & NO OBLIGATION Seller Consultation

- Click here to Check your Gilbert home's value instantly

- Not Thinking of Selling Right Now? – Text Update to 480.788.6408 and Your Zip Code and I will send you the following update on the 1st of every month. NO SPAM – JUST ONE INFORMATIVE TXT PER MONTH

- Call 480.721.6253 or Contact Us to schedule a Complimentary & NO OBLIGATION Buyer Consultation

- TXT AZ246 to 32323 to Download My GPS enabled Mobile App and Browse Homes on your smartphone

Swee Ng, Realtor and Gilbert AZ resident specializing in win-win real estate transaction through great communication and fighting for his clients' best interest. After all, this is more than real estates, this is about your life and your dreams.

If you are looking to buy or sell your home in Gilbert AZ, we hope you will consider us. Contact us today for complimentary consultation.

Buyer's Representation Services (NO COST TO HOMEBUYERS)

If you are looking to buy or sell your home in Gilbert AZ, we hope you will consider us. Contact us today for complimentary consultation.

Wednesday, July 18, 2012

The Secret to Getting a Mortgage or Refi Rate Near 3%

7:03 PM

Swee Ng

Can you get a 3.875 percent interest rate? First, you have to understand that not every lender offers a loan carrying a super-low interest rate, and only people with the best credit need apply.

But there's more to the story. If you want to land the best loan with the best rate and terms, you'll need two things: credit and cash.

Your Credit

Many borrowers don't understand the direct link between your credit and your loan. The better your credit history and the higher your credit score, the lower your interest rate and the better your terms.

If you've missed some payments – or even if you're only 30 days late on one bill – your credit history is tarnished, your credit score reduced, and your interest rate will be far higher.

Your Cash Outlay

But don't forget about cash. These days, lenders want to see you walk through the door with at least 20 percent to put down on the property. If you don't have at least 20 percent equity (if you're refinancing) or 20 percent in cash for your down payment, your interest rate will be higher.

For example, if your credit score is 760 to 850 and you have at least 20 percent equity, you're in the highest credit tier, which means you might qualify for an interest rate at 3.282 percent on a 30-year fixed rate loan or less than 3 percent on a 15-year fixed rate mortgage.

But if your credit score drops into the second-highest tier (700 to 759), you might only qualify for a 30-year loan at 3.504 percent. To be sure, a loan at 3.5 is still a historically amazing rate. In fact, today's interest rates are so low that you might qualify for a loan below 4 percent even if your credit score is a 660. But you may need to have as much as 50 percent in equity or for your cash down payment.

The right lender

The key to finding a great loan with a terrific interest rate is finding the right mortgage lender to give it to you. But here's where it gets a little sticky. There are plenty of lenders who don't want your business. They might be overweighted with bad real estate loans, or they might not need any loans from people with less than perfect credit scores, even if you have plenty of equity in the property.

But instead of telling you they don't want your business, they'll just quote you an interest rate or loan terms that are, shall we say, less than palatable. By comparison, these quotes will look downright expensive.

Of course, if you don't shop around for a lender, you won't know that you're being quoted an interest rate that's too high or offered a loan program that doesn't make sense for your finances. So talk to a variety of lenders and make sure you understand exactly what you need to do to close on a loan that offers an interest rate for less than 4 percent.

via yahoo homes

4 Bedrooms For Sale in Wind Drift Gilbert 85234

6:56 PM

Swee Ng

|

|

||||

|

|

4 Bedrooms HUD Home For Sale in Gilbert 85234. Sharp home in 'lake' subdivision w/tile floors in family room, kitchen, baths, hall laundry. Vaulted ceilings, ceiling fans, island kitchen with breakfast bar, skylight, smooth top range, built-in micro & dishwasher bay windows in brkfast nook & master, Master has shower/tub & walk-in closet. 4th bedroom could be used as den or bedroom as it has closet and double doors. Fresh Paint! Plantation Shutters. Backyard gardens used to have 'English Flair'.

School District: 041 - Gilbert Unified District

Elementary School: Sonoma Ranch Elementary

Jr. High School: Greenfield Junior High

High School: Gilbert High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Wind Drift Community

View Homes for Sale in Gilbert 85234

View Homes for Sale in Gilbert

School District: 041 - Gilbert Unified District

Elementary School: Sonoma Ranch Elementary

Jr. High School: Greenfield Junior High

High School: Gilbert High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Wind Drift Community

View Homes for Sale in Gilbert 85234

View Homes for Sale in Gilbert

* Important Disclosure: The property is available at the time of this ad creation. It is very possible that an offer has been submitted or even accepted since that time. If you are interested in this property, Please call 480-721-6253 to check on its current availability.

3 Bedrooms with Pool Gilbert 85234 Home For Sale

6:45 PM

Swee Ng

|

|

||||

|

|

3 Bedrooms HUD Home with Pool Gilbert 85234 Highland High School boundary For Sale. Stunning Gilbert Beauty with Pebble Tech Pool.. Single Story Cul-de-Sac 3bedroom, 2bath, 2 Car Garage, Bright Open Tiled Island Eat in Kitchen with Appliances, Formal Living - Dining -Family Room, Gas Fireplace, Vaulted Ceilings, Bay Window, Custom Blinds Paint, Ceiling Fans, Master with 2 Sinks, Tub & Shower & walk-in-closet, Covered Patio into Private Pebble Tech Pool, RV gate, built in cabs in garage along w/ work bench, Near shopping , restaurants, Gilbert Schools and I-60 Freeways.

School District: 041 - Gilbert Unified District

Elementary School: Pioneer Elementary

Jr. High School: Highland Junior High

High School: Highland High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Gilbert 85234

View Homes for Sale in Gilbert

School District: 041 - Gilbert Unified District

Elementary School: Pioneer Elementary

Jr. High School: Highland Junior High

High School: Highland High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Gilbert 85234

View Homes for Sale in Gilbert

* Important Disclosure: The property is available at the time of this ad creation. It is very possible that an offer has been submitted or even accepted since that time. If you are interested in this property, Please call 480-721-6253 to check on its current availability.

Tuesday, July 17, 2012

Reasons Your Mortgage Rate is High - and How You Can Fix It

11:10 AM

Swee Ng

Hate shopping?

Don't pay your bills on time?

Rarely keep track of your mortgage payments?

If you answered yes to any of the above questions, your sky-high mortgage rate could be caused by ... you.

That's right, even your personal shopping habits could play a role in how high your mortgage rate is.

But don't despair; there are some actions you can take to potentially help you lower your rate, says Fred Arnold, director of the National Association of Mortgage Brokers.

Keep reading to learn more about reasons why your mortgage rate is so high, and tips to fix it.

Reason 1: You Didn't Shop Around

Unless you're a billionaire, you probably value a good deal. And if you want a stellar bargain on your mortgage rate, shopping around is essential.

In fact, you'll probably want to put your shopping shoes on once you hear this bit of news: failing to shop around -- and not researching the rates of different providers -- could be a reason your mortgage rate is so high.

"A mortgage -- whether it's a home purchase, a refinancing, or a home equity loan -- is a product, just like a car," so you may have the option to bargain with your lender for a better rate, notes the website of The Federal Reserve, the central banking system of the United States.

"Shopping, comparing, and negotiating may save you thousands of dollars," says the website.

Fix-it tip: Compare rates for every company you shop around with, and see who offers the best rate. But that's not all. Arnold says you have to trust your lender, too.

"Shop online to get an idea of average rates, but get quotes from people who are local - people who you can walk into their office and see who they are," says Arnold. "You'll also want to get referrals from someone you can trust."

Reason 2: You Have a Bad Credit Score, And You're Not Doing Anything About It

Unfortunately, having a bad credit score tends to make life harder than it has to be. On top of potentially affecting things like insurance premiums and security deposits, a poor credit score can also affect your mortgage rate.

Why? Because many mortgage lenders view your credit score as a reflection of your financial habits.

Luckily, it's not the only thing used to determine your mortgage.

In fact, "a good credit score is only one of the factors that home lenders look at when deciding whether to lend you money," according to the Consumer Financial Protection Bureau website.

"Just because you have a good credit score does not mean that the lender is going to give you the lowest cost mortgage loan available," adds the bureau, which notes that your debt, income, assets, and savings are other notable factors that a lender may consider when determining mortgage rates.

Fit tip: Don't let your bad credit score hold you back from a potentially lower mortgage rate. Take action to help improve your credit, suggests Arnold.

"One way to improve your credit would be to resolve any collections in a favorable manner," says Arnold. "Try to pay down your debt to 50 percent."

Reason 3: You Didn't Refinance

What's another reason that may be contributing to your high mortgage rate? The fact that you haven't refinanced.

Refinancing: It's a term you've probably heard of, but do you know what it means?

If you answered "no," don't sweat it. Refinancing your mortgage is simply the restructuring of your current mortgage, oftentimes at a lower interest rate and different loan terms.

And as you might imagine, refinancing your mortgage could help ease your purse strings.

According to Massachusetts' Citizen Information Service website: There are several reasons to refinance your home, including the potential "to lower the interest rate on your mortgage; reducing your monthly payments and overall costs."

It also notes, though, that refinancing may not be for everyone, as the refinancing costs may outweigh the savings.

Fix-it tip: To help you figure out if refinancing is the right move for you, you'll want to ask yourself some questions. Massachusetts' Citizen Information Service recommends the following:

- How much can I lower my current monthly payment?

- How long do I plan to stay in the house after I refinance?

- How much will I pay in refinancing costs?

Reason 4: You Have a Long-Term Loan

Are you familiar with the phrase "The sooner you get it over with, the better"? Well, that expression rings especially true when it comes to paying off your mortgage.

Why? Because when you're able to pay off your mortgage sooner, it's likely that the interest rate on your mortgage will take a dip -- and then some.

"Shorter-term mortgages -- for example, a 15-year mortgage instead of a 30-year mortgage -- generally have lower interest rates," the Federal Reserve website says. "Plus, you pay off your loan sooner, further reducing your total interest costs."

As an example of the potential savings a short-term mortgage can yield, the Federal Reserve Board suggests comparing the total interest accrued for a fixed-rate loan of $200,000 at 6 percent for 30 years, with a fixed-rate loan at 5.5 percent for 15 years:

Fix-it tip: Of course, this is only an option if you -- and your back account -- can afford to make higher monthly payments and in effect, pay more of your principal each month. So, you'll want to take a look at your finances and determine how much you can afford to cough up each month. Though you may have to make some sacrifices, it could potentially pay off in the long run.

Reason 5: You Didn't Get Rid of Your Private Mortgage Insurance (PMI)

It sucks to be punished for not having enough money, but unfortunately, it happens.

Case in point: If you were unable to put a 20 percent down payment on your home, you were probably charged a private mortgage insurance (PMI), which protects your lender in the event you default on your loan, notes the Federal Trade Commission's website.

Thankfully, "For home mortgages signed on or after July 29, 1999, your PMI must -- with certain exceptions -- be terminated automatically when you reach 22 percent equity in your home based on the original property value, if your mortgage payments are current," says the FTC.

But did you know that you're actually eligible to get rid of your PMI once you've reached 20 percent equity in your home?

Indeed you can. But there's a catch. Your PMI can only be canceled at 20 percent equity if you request it. Otherwise, you'll be paying it until the 22 percent mark.

Fix-it tip: Pay attention to your payments and balance. Once you notice that your balance is at 79.9 percent of your home value, pick up your cell phone, contact your lender, and tell them to kick your PMI to the curb.

via yahoo homes

4 Bedrooms Lyon's Gate Gilbert For Sale

11:00 AM

Swee Ng

|

|

||||

|

|

4 Bedrooms 3.5 Bathrooms HUD Homes in Gilbert 85295 For Sale. Situated on a corner lot in the desirable Gilbert community of Lyon's Gate, you'll be close to great shopping, parks, schools, and freeways! Charming curb appeal makes this home a winner! Spacious floor plan consists of neutral carpet, tile, and much, much more! Enter an open dining/living room area along with sleek kitchen, complete with black appliances. Great room features a built in wall niche and a beautiful tile fireplace! Enjoy the peace and quiet of your master bedroom, which features a large master bathroom with separate shower/tub and double sinks. Side yard is intimate and features a covered patio, and is ready for your own personal ideas!

School District: 060 - Higley Unified District

Elementary School: Higley

Jr. High School: Williams Field

High School: Williams Field

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Lyon's Gate

View Homes for Sale in Gilbert 85295

View Homes for Sale in Gilbert

School District: 060 - Higley Unified District

Elementary School: Higley

Jr. High School: Williams Field

High School: Williams Field

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in Lyon's Gate

View Homes for Sale in Gilbert 85295

View Homes for Sale in Gilbert

* Important Disclosure: The property is available at the time of this ad creation. It is very possible that an offer has been submitted or even accepted since that time. If you are interested in this property, Please call 480-721-6253 to check on its current availability.

Sunday, July 15, 2012

Thursday, July 12, 2012

Gilbert Ranch Real Estate and Homes for Sale

2:46 PM

Swee Ng

Gilbert Ranch Real Estate and Homes for Sale | Gilbert AZ 85295

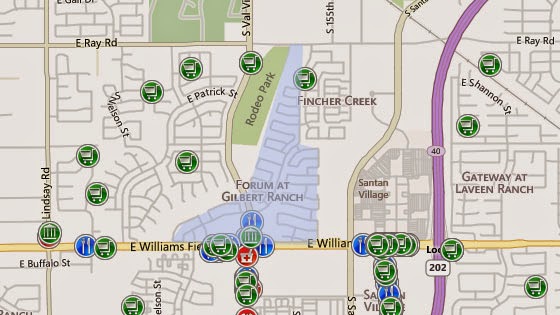

Last updated on July 27, 2015Gilbert Ranch is located just south of Ray Road, with part of it spanning across the major thoroughfare of Val Vista Drive to the east and west in Gilbert AZ 85295. The northern portion of the neighborhood sits adjacent to the Gilbert Rodeo Park. The neighborhood features several small parks, walkways, volleyball and basketball courts, playgrounds, and open fields for sports. Homes in Gilbert Ranch were built in late 1990 and are ranging from 1,100 - almost 4,000 sq/ft.

Conveniently Located in Gilbert Ranch

Residents in Gilbert Ranch enjoy near by shopping, grocery stores, restaurant and other amenities. Gilbert Ranch is only minutes from San Tan Village and convenient to the 202 loop.

Community and Demographic Information for Gilbert Ranch

Gain valuable insight into the Gilbert Ranch community by looking at household incomes, crime risk, education levels attained, and weather information. Use the map to locate points of interest like shopping, restaurants, and health care services.

Gilbert Ranch is served by Gilbert Unified School District. School aged children attend Ashland Elementary, South Valley Jr High and Campo Verde High School. Access Gilbert 85295 school detailed information on the Gilbert Unified School District, school ratings, test scores by grade, student-teacher ratio, and much more.

Affordable Financing Options

Several low down payment financing options including; FHA 3.5% Down Financing, VA ZERO Down Financing, Conventional Financing and others are available. Contact Us to find out what loan programs you qualify for. Learn more about how to buy a house in Gilbert AZ with a low down payment.

Free Gilbert 85295 Market Report

Sign Up for Free Gilbert AZ 85295 Market Report. The data used this Gilbert 85295 Market Report is consolidated from multiple sources and includes current listings, recent sales, and more. Whether you’re a buyer or seller, the knowledge you gain will help put you in control of your real estate transactions.

View Homes for Sale in Gilbert Ranch

Ready to Sell?

- Call 480.721.6253 or Contact Us to schedule a Complimentary & NO OBLIGATION Seller Consultation

- Go to sell.sweephoenixhomes.com for Comprehensive Marketing Plan when list with us

- Click here to Check your Gilbert home's value instantly

- Click here and Enter your zipcode and find out Market Snapshot for Free

- Not Thinking of Selling Right Now? – Text Update to 480.788.6408 and Your Zip Code and I will send you the following update on the 1st of every month. NO SPAM – JUST ONE INFORMATIVE TXT PER MONTH

- Call 480.721.6253 or Contact Us to schedule a Complimentary & NO OBLIGATION Buyer Consultation

- TXT AZ246 to 32323 to Download My GPS enabled Mobile App and Browse Homes on your smartphone

Swee Ng

Swee Ng

Keller Williams Realty

sweeng@kw.com

15905 S 46th St #160

Phoenix

,

AZ

,

85048

480-721-6253

Swee Ng, Realtor with Keller Williams Realty who live, work and play in Gilbert AZ, specialty in Residential Resale, First Time Home Buyer and Investment Homes.

Visit www.SweeEastValleyHomes.com for your Gilbert Real Estate needs.

Go to www.GilbertAZHouseValue.com to find out what your Gilbert house is worth instantly.

4 Big Money Mistakes of First-Time Homebuyers

11:50 AM

Swee Ng

First-time homebuyers almost always make a few mistakes when buying their home. Perhaps they pay too much, choose the wrong type of mortgage or neglect to budget for needed home improvements.

Working with a trustworthy, experienced lender can help prevent such mistakes. But consumers also need to take responsibility for their budgets and choices.

"Before buying a home, consumers need to develop a short- and long-term perspective on their purchase," says Michael Harrison, area director for MetLife Home Loans in Southwest Ohio.

Following are the four biggest financial mistakes of first-time homebuyers:

Spending the maximum on housing

Lenders qualify buyers based on their incomes and debt-to-income ratios without considering how much the borrowers spend on items such as transportation, savings, food and other necessities.

"A lot of first-time buyers are optimistic about the future and excited about buying a home, so they borrow the absolute maximum they can afford instead of allowing themselves wiggle room for a partial loss of income or for future expenses such as children," Harrison says.

Financial experts recommend that consumers decide how much they want to spend each month on housing before meeting with a lender.

"Every buyer should create their own budget and know their limits," says Stephen Adamo, president of Weichert Financial Services in Morris Plains, N.J.

Adamo says many first-time homebuyers experience a sizable change in their housing payments. Some new owners may go from $500 per month in rent to a monthly mortgage payment of $2,000, he says.

"You need to deal with payment shock," Adamo says.

Not getting prequalified early enough

Meeting with a lender for a buyer consultation and prequalification for a mortgage should be the first step toward homeownership. Yet many first-time homebuyers wait until they are ready to start house hunting before contacting a lender.

"It's never too early to set up a free buyer consultation with a lender," Adamo says. "Every buyer needs to get prequalified early enough in the process so that they can make some changes if they need to or correct errors on their credit report."

Some buyers may need to spend up to a year saving more money, increasing their incomes or cleaning up their credit before making an offer on a home.

A buyer consultation should include creating long-term financial goals and strategies for buying property, Adamo says.

Misunderstanding the importance of a high credit score

While most consumers know it's important to have a high credit score, not everyone understands how costly a low score can be.

"All mortgage lending is done with a tier of interest rates and terms based on consumer credit scores," Harrison says. "A credit score of 720 or above will earn you the best rates and can potentially save you thousands of dollars."

A score of 680 to 720 can get you good mortgage rates, while a FICO score of 620 is usually about the lowest score to qualify for most loans, Harrison says.

Consumers should learn about credit scores the minute they start working, Harrison says.

Websites such as Bankrate provide information about how to improve your credit score.

Even after a mortgage approval, consumers must avoid applying for new credit or taking on new debt, Adamo says, because a second credit check is often required before settlement.

Choosing the wrong mortgage product

First-time homebuyers today typically opt for a 30-year fixed-rate mortgage. Their conservatism is a reaction to stories about the dangers of interest-only mortgages and adjustable-rate mortgages.

But Harrison says home loan alternatives to a 30-year-fixed sometimes make more sense. For example, buyers certain they will be relocated by their companies within five years may find a 5/1 ARM "could be a much better mortgage," he says.

"There's no reason to pay a premium for a product you don't need like a 30-year loan," Harrison says.

Homebuyers eager to build equity in their homes or who are older and want to live mortgage-free in retirement should consider a 15-year fixed-rate loan or, if they can afford it, even a 10-year mortgage to reach their goals.

via bankrate

today for FREE buyer consultation.

Wednesday, July 11, 2012

Toll Brothers National Sales Event July 14 - 29

9:56 AM

Swee Ng

This event will offer you substantial savings and incentives so you can build more into your dream home for less money. Interest rates are still at historic lows, so this is the perfect time to make your dream come true. Take advantage of this opportunity.

Call me at 480-721-6253 to represent you as Buyers' Agent.

Buyer's Agent

9:43 AM

Swee Ng

Q: Who Represents Home Buyers?

A: NOBODY... unless you use Buyer's Agent

Introducing: Buyer's Agent Services

Listing Agents represent seller.

Builder Home Sales Associate represent builder.

Who represents buyers in real estate purchases?

Only Buyer's Agent and their Brokers represent buyers.

Do I need a Buyer agent?

Do you need someone to:

- Explain the terms and conditions in Purchase Contract?

- Negotiate price?

- Coordinate inspection, appraisals, walk-through?

- Answer to any question / resolve the issues during the contract periods?

- Work at your BEST interest?

- If you answer is YES for all the above questions, then you will need a Buyer's Agent.

A Buyer's Agent will:

- Acts in the Buyer's best interest.

- Has a duty to disclose all facts to the buyer.

- Has a duty to advice the buyer.

- Obeys all legally permissible instructions.

- Maintains the confidentiality of the buyer's position.

- Negotiates on the buyer's behalf.

- Opens up all properties (FSBO) and ("Not on the market")

- All buyers have the right to representation. Whether you move into town or across town.

My personal commitment to you as Buyer's Agent

- I will listen to you, because when I fully understand your real estate goals, I can help you achieve them.

- I will represent you with integrity and find you a home that best matches your needs.

- I will help you through the offer, financing, and escrow processes.

- I will communicate with you by keeping you up to date at every stage of the sales process.

- I will stay aware of the latest market trends and keep you updated.

- I won’t push you into buying a home. Instead I offer knowledgeable and trusted advice.

today for FREE & NO OBLIGATION consultation.

Tuesday, July 10, 2012

4 Bedrooms Home For Sale Park Village Gilbert 85234

11:37 AM

Swee Ng

|

|

||||

|

|

4 Bedrooms HUD Home For Sale Park Village community Gilbert 85234. Feature real hardwood floors and travertine tile in the bathrooms. 4 bed, 3 bath, 2 car garage, 2 story with a bedroom downstairs. Formal living and dining room. kitchen that opens to a great room has granite countertops and a pantry. Laundry room has cabinets. garage has extra cabinets. enjoy your double door master bedroom retreat. master bath has double vanity and separate tub and shower.

Elementary School District: 041 - Gilbert Unified District

Elementary School: Patterson Elementary

Jr. High School: Gilbert Jr High

High School: Gilbert High School

Elementary School District: 041 - Gilbert Unified District

Elementary School: Patterson Elementary

Jr. High School: Gilbert Jr High

High School: Gilbert High School

Click here for more information and photos for this listing. You also find out more about the community, school report, crime report and much more...

View Homes for Sale in 85234

View Homes for Sale in 85234

* Important Disclosure: This property is available at the time of this ad creation. It is very possible that an offer has been submitted or even accepted since that time. If you are interested in this property, Please call 480-721-6253 to check on its current availability.